Life & Health Benefits – Disability Insurance Program OSOT

Get a Quote

About Disability Insurance

Regardless of what job you have, if you rely on a paycheck, you should at least consider disability coverage.

What is Disability Insurance?

Disability Insurance protects your income if you’re unable to work because of a serious physical injury or ailment. Payments can be short-term or long-term and will end when you start working again or retire.

Who needs Disability Insurance?

Everyone, especially if you:

- Work a physically intensive job

- Are self-employed (you might not have access to traditional employer benefits)

- Have dependents (who’d support your family?)

- Have no dependents (who’d support you?)

Why do I need Disability Insurance?

We get it. It’s hard to picture a future where you can’t work if you’re in perfect health right now. But you never know when you’ll suffer a disability. Even a small accident or fall on your way home can leave you hospitalized or bedridden for months.

And serious injuries aren’t just stressful; they’re also financially draining. In the absence of a salary, your savings can dry up quickly, especially with medical costs and your day-to-day living costs. With Disability Insurance, you’ll have the financial security you need to recover on your own terms.

About Disability Insurance

Regardless of what job you have, if you rely on a paycheck, you should at least consider disability coverage.

What is Disability Insurance?

Disability Insurance protects your income if you’re unable to work because of a serious physical injury or ailment. Payments can be short-term or long-term and will end when you start working again or retire.

Who needs Disability Insurance?

Everyone, especially you if you:

- Work a physically intensive job;

- Are self-employed (you might not have access to traditional employer benefits);

- Have dependents (who’d support your family?);

- Have no dependents (who’d support you?).

Why do I need Disability Insurance?

We get it. It’s hard to picture a future where you can’t work if you’re in perfect health right now. But you never know when you’ll suffer a disability. Even a small accident or fall on your way home can leave you hospitalized or bedridden for months.

And serious injuries aren’t just stressful; they’re also financially draining. In the absence of a salary, your savings can dry up quickly, especially with medical costs and your day-to-day living costs. With Disability Insurance, you’ll have the financial security you need to recover on your own terms.

Disability Insurance Coverage Highlights

FEATURES

Coverage for Regular Occupation to Age 65

Receive coverage if you are considered disabled and unable to perform the duties of your regular occupation until age 65.

*Can be added to Foundation Series for an additional cost.

Total Disability Benefits

Receive a monthly benefit up to a certain limit in the event of an injury that prevents you from working.

Partial and Residual Disability Benefits

Receive a monthly benefit (subject to policy rules) if you can only work part-time because of an illness or injury.

Choice of Benefit Periods

Determine whether you want to receive benefits for two years, five years, or until age 65.

Return to Work Assistance Benefits

Access services like rehabilitation, on-site training, and more, to help you get back to work.

Non-cancellable

Benefit from consistent premiums and coverage. Your insurer cannot change the policy or premiums or cancel the policy until age 65.

Recovery Benefit

Receive a portion of your monthly benefit for up to four months following your return to work after a total or residual disability, or two months following a partial disability, if you experience a decrease of 20% or more in your earnings.

Medical Confidence™ Service

Access faster care and treatment from specialists, 1:1 support from RNs, and more.

Long-Term Care Conversion Option

Convert all (or some) of your coverage to long-term care insurance from age 55-65, without needing to provide evidence of good health.

Waiver of Premium During Disability

You will not have to pay your premium if you are disabled and receiving your benefits.

Portable

Keep your policy, even if you change jobs.

PROFESSIONAL SERIES

FOUNDATION SERIES

Please note the above chart offers general information only. It is not meant to be exhaustive nor will it apply to all policies, individuals, situations, or circumstances. Limits and exclusions apply. Please contact a licensed insurance representative for information or advice on all insurance-related matters.

Disability Insurance Coverage Highlights

FEATURES

Coverage for Regular Occupation to Age 65

Receive coverage if you are considered disabled and unable to perform the duties of your regular occupation until age 65.

*Can be added to Foundation Series for an additional cost.

Total Disability Benefits

Receive a monthly benefit up to a certain limit in the event of an injury that prevents you from working.

Partial and Residual Disability Benefits

Receive a monthly benefit (subject to policy rules) if you can only work part-time because of an illness or injury.

Choice of Benefit Periods

Determine whether you want to receive benefits for two years, five years, or until age 65.

Return to Work Assistance Benefits

Access services like rehabilitation, on-site training, and more, to help you get back to work.

Non-cancellable

Benefit from consistent premiums and coverage. Your insurer cannot change the policy or premiums or cancel the policy until age 65.

Recovery Benefit

Receive a portion of your monthly benefit for up to four months following your return to work after a total or residual disability, or two months following a partial disability, if you experience a decrease of 20% or more in your earnings.

Medical Confidence™ Service

Access faster care and treatment from specialists, 1:1 support from RNs, and more.

Long-Term Care Conversion Option

Convert all (or some) of your coverage to long-term care insurance from age 55-65, without needing to provide evidence of good health.

Waiver of Premium During Disability

You will not have to pay your premium if you are disabled and receiving your benefits.

Portable

Keep your policy, even if you change jobs.

PROFESSIONAL SERIES

FOUNDATION SERIES

Please note the above chart offers general information only. It is not meant to be exhaustive nor will it apply to all policies, individuals, situations, or circumstances. Limits and exclusions apply. Please contact a licensed insurance representative for information or advice on all insurance-related matters.

What Our Clients Are Saying

"I really appreciate that PROLINK always take the time to listen and present me with insurance options in a way that is easy to understand. I never feel that I am being sold something that I don't need."

- Anne-Marie S.

"We've worked with PROLINK for many, many years now and they have always been very responsive and helpful. The folks there have always paid attention to detail and have been great explaining the details and options etc to me!"

- Mike H.

"My agent was terrific. She was knowledgeable and spoke to me about what I needed and didn't need, saving me a bit of money by not buying something I didn't need to buy."

- Jonathan C.

"This company is always there when I need help. They are quick to respond and are quick to follow through on my concerns. Very understanding and caring. Always professional. They treat me with the upmost respect. My experiences with Shameen have been excellent."

- Debra P.

"Excellent service and prompt response to questions! Couldn't have asked for more! Keep up the great work PROLINK team!"

- Pradheepan M.

"I have been a long-time client of PROLINK. I have found their rates to be competitive. I don't like to hop from one company to another. So having rate confidence is important. I have found that account managers (customer service ) to be excellent in addressing all my accounts needs. I wish I could acknowledge each one. If you are looking for insurance PROLINK should be on your list."

- Er E.

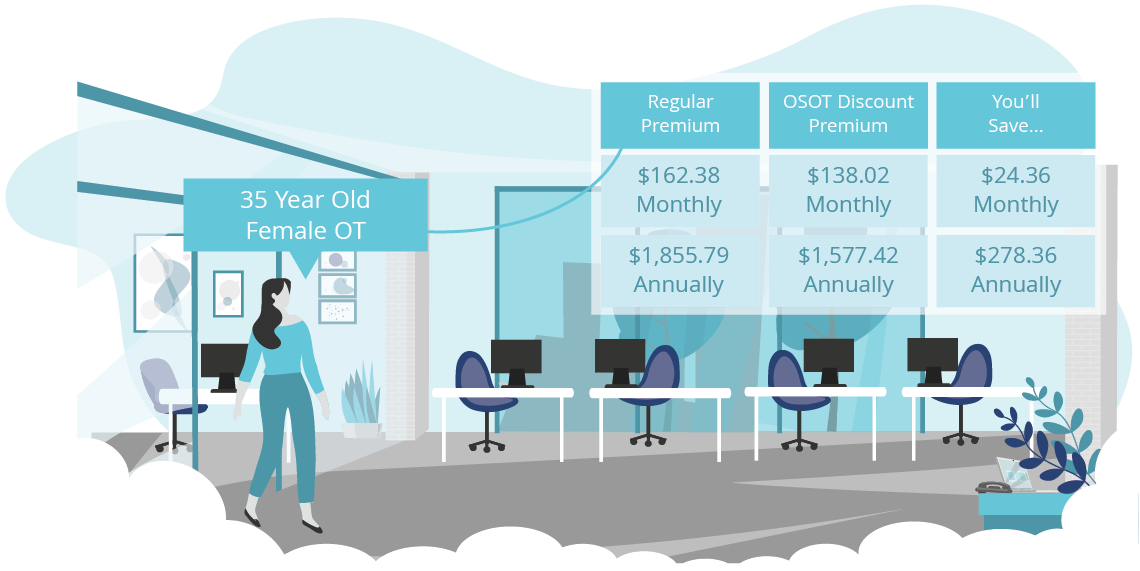

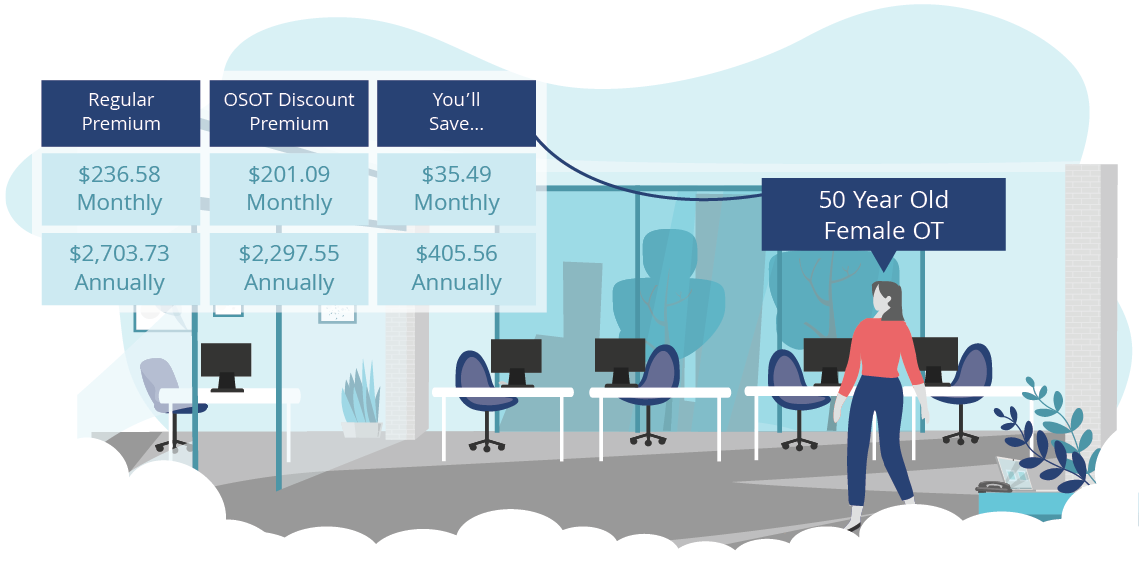

Premium Indicator

The premiums indicated below are based on the Professional Series Disability Insurance Plan, for a non-smoking woman, earning $75,000 annually and receiving a monthly benefit of $4,175. It is important to note that these premium rates are guaranteed until age 65 and cannot be cancelled or changed by the insurance company. That means, if you buy your policy at a younger age, you will continually pay less on a yearly/monthly basis than if you wait until you are close to retirement.

(Slide the arrows left and right to view premium details)

Get In Touch

To speak to a professional who can guide you to the right coverage from the right insurer at the right price call us at:

1 800 663 6828

or email us at:

Get In Touch

To speak to a professional who can guide you to the right coverage from the right insurer at the right price call us at:

1 800 663 6828

or email us at:

![OSOT_Logo [Converted] OSOT](https://prolink.insure/wp-content/uploads/2018/11/OSOT_Logo-Converted-300x57.png)