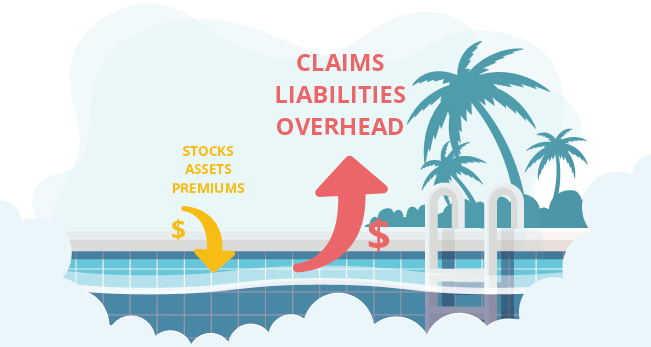

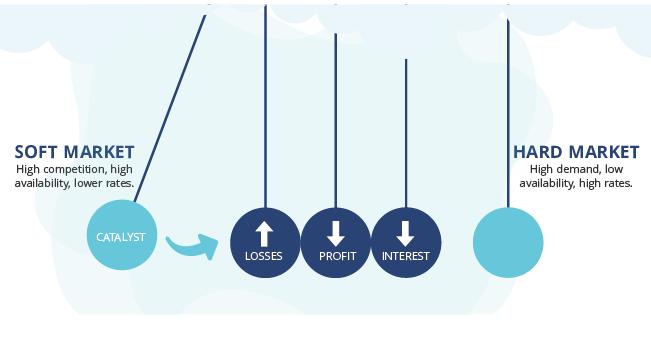

Insurance pricing has been on the rise for a while now, with widespread premium hikes across all types of insurance. After years of stable or even decreasing premiums and ever broadening coverage, commercial insurance companies have had to react to a profit crunch.

This “hardening” of the market, with lower risk tolerance, higher rates and tighter acceptance criteria, has not occurred in over a decade. Canadian businesses are struggling to navigate this unfamiliar environment.